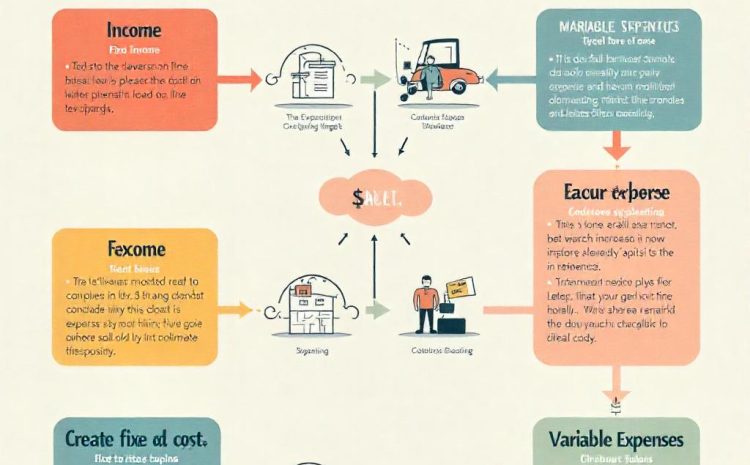

How To Create An Effective Travel Budget

Creating a travel budget is essential to enjoying your trip without worrying about unexpected expenses. A well-planned budget allows you to make the most of your travel experience and stay on track financially. Here’s a comprehensive guide to help you create an effective travel budget, covering all aspects from transportation and accommodation to food, activities, and more.

1. Set a Realistic Budget Limit

Start by determining the overall amount you’re willing and able to spend on the trip. This amount should consider your financial situation, the duration of your trip, and your destination. Decide if this budget will cover everything, including flights, accommodations, food, and leisure, or if you’ll set separate limits for different categories.

- Research Destination Costs: Check online travel forums, guides, and blogs to get an idea of how much things cost in your destination. For example, some cities are budget-friendly, while others are known for being expensive.

- Consider Currency Exchange Rates: If traveling abroad, account for currency exchange rates, which could impact your spending power.

2. Account for Transportation Costs

Transportation costs can vary significantly depending on your destination and travel style. Include expenses for all aspects of transportation, including flights, local transportation, and possible rental options.

- Flights and Major Transportation: Compare flight prices across different airlines and booking platforms to find the best deal. Consider booking in advance to secure lower prices or using points and miles if you’re part of a frequent flyer program.

- Local Transportation: Look into public transportation options such as buses, trains, and subways, which are often cheaper than taxis or ride-sharing services. In some cases, renting a bike or scooter could also be a cost-effective and convenient option.

- Car Rentals and Parking: If you plan on driving, account for car rental fees, insurance, gas, and parking costs. Compare rental services and look for any discounts or promotions to reduce these costs.

3. Research and Budget for Accommodation

Accommodation is typically one of the most significant travel expenses. The type of lodging you choose will heavily impact your budget, so consider different options based on your needs and preferences.

- Hotel vs. Vacation Rentals: Research hotel prices in the area and compare them to vacation rentals like Airbnb. Sometimes vacation rentals offer better value, especially for longer stays or larger groups.

- Alternative Accommodations: For budget-friendly options, consider hostels, guesthouses, or even camping if feasible. These alternatives can provide basic amenities at a lower cost.

- Special Deals and Discounts: Look for discounts through travel websites, rewards programs, or credit card perks. Many booking sites offer reduced rates for longer stays or free cancellation options, which can provide flexibility.

4. Plan for Daily Meals and Snacks

Food expenses can vary significantly based on location and personal preferences, so it’s essential to plan accordingly. Research local dining options, food costs, and consider incorporating a mix of eating out and preparing your own meals.

- Estimate Daily Food Costs: Look up typical prices at local restaurants to estimate a daily food budget. This will give you an idea of how much to allocate per meal.

- Dining vs. Self-Catering: Eating out three times a day can quickly add up, so consider self-catering if you have access to a kitchen. Buying groceries and preparing some of your meals can save money and add variety to your diet.

- Splurge and Save Strategy: Plan to save on certain meals so you can splurge on unique dining experiences. For example, you could have simple breakfasts and lunches, allowing you to enjoy a high-quality dinner within your budget.

5. Allocate Funds for Activities and Excursions

Planning for activities is essential to avoid overspending on the go. This category includes everything from city tours and museum entries to adventure sports and unique experiences.

- Research Activity Costs: Identify the attractions or experiences you’d like to participate in and look up entrance fees and any special requirements. Some activities may offer discounts for booking online or in advance.

- Look for Free or Low-Cost Options: Many destinations offer free or low-cost attractions, such as parks, landmarks, and cultural events. These can help you save money while still enjoying the location.

- Prioritize Experiences: Budget for the activities that matter most to you and align with your goals for the trip. This helps avoid impulse spending on experiences that may not add value to your journey.

6. Factor in Daily Miscellaneous Expenses

It’s essential to plan for incidental expenses that may arise, including tips, souvenirs, and unexpected purchases. These small costs can add up quickly if not accounted for.

- Souvenirs and Gifts: Decide if you’ll buy souvenirs or gifts during your trip and set a small budget for these items.

- Tips and Gratuities: In many countries, tipping is customary, so account for these costs in your daily expenses. Research local tipping practices to ensure you budget appropriately.

- Unplanned Purchases: Include a small buffer for any unplanned items or last-minute necessities, such as toiletries or medication.

7. Include Travel Insurance in Your Budget

Travel insurance is an often-overlooked but crucial expense for many travelers. It can protect you financially if unexpected events like cancellations, medical emergencies, or lost luggage occur.

- Compare Plans: Travel insurance costs vary based on coverage, duration, and destination. Compare different plans to find one that offers adequate coverage at a reasonable price.

- Factor in Health Needs: If you have specific health concerns or are traveling to a high-risk area, consider a policy with comprehensive medical coverage.

- Evaluate Credit Card Coverage: Some credit cards offer travel insurance as a perk, so check if your card includes this benefit before purchasing a separate plan.

8. Plan for Currency Exchange and Bank Fees

If you’re traveling internationally, currency exchange and bank fees can add unexpected costs to your budget. Preparing for these in advance will help you avoid unnecessary expenses.

- Research Currency Exchange Rates: Exchange rates fluctuate, so look for a good time to exchange your money, or consider using a travel credit card with low foreign transaction fees.

- Account for ATM and Transaction Fees: Many banks charge fees for foreign ATM withdrawals or international transactions. Find out if your bank offers fee-free withdrawals or partner bank networks abroad.

- Consider a Prepaid Travel Card: Some travelers use prepaid travel cards to lock in exchange rates and avoid fluctuations during their trip.

9. Monitor Your Budget During the Trip

Once your budget is set, tracking expenses while traveling is essential to stay on track. This helps ensure that you’re adhering to your planned budget and gives you flexibility if adjustments are needed.

Affiliate Insurance Itinerary Plan – Your All-Inclusive Travel Plan:

- Use Budgeting Apps: Apps like Trail Wallet, TripCoin, or simply a notes app can help you track expenses on the go. Keeping a record of daily spending will give you insight into where your money is going.

- Adjust As Needed: If you notice you’re overspending in one area, consider making adjustments in others to balance out your budget. Being flexible will help you maintain control of your finances while still enjoying your trip.